All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Holding money in an IUL fixed account being attributed rate of interest can often be better than holding the money on down payment at a bank.: You have actually constantly imagined opening your very own bakery. You can obtain from your IUL policy to cover the initial expenditures of renting a space, acquiring equipment, and hiring personnel.

Credit score cards can offer an adaptable way to obtain money for extremely short-term periods. Obtaining cash on a credit report card is generally extremely costly with yearly portion prices of rate of interest (APR) often reaching 20% to 30% or even more a year.

The tax therapy of plan car loans can differ significantly depending upon your country of residence and the details regards to your IUL plan. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan loans are typically tax-free, supplying a substantial advantage. However, in other territories, there may be tax implications to take into consideration, such as possible tax obligations on the financing.

Term life insurance only gives a fatality benefit, without any kind of cash money worth build-up. This implies there's no money worth to borrow versus.

Help With “Becoming Your Own Banker” Criticism

Envision stepping into the monetary universe where you're the master of your domain, crafting your very own course with the skill of an experienced lender however without the restrictions of imposing establishments. Invite to the world of Infinite Banking, where your economic fate is not just a possibility however a tangible truth.

Uncategorized Feb 25, 2025 Money is just one of those points we all deal with, yet many of us were never truly taught exactly how to utilize it to our benefit. We're told to conserve, invest, and budget, however the system we operate in is created to maintain us dependent on financial institutions, regularly paying interest and fees just to accessibility our very own cash.

She's a professional in Infinite Banking, a strategy that helps you take back control of your financial resources and construct genuine, long-term wealth. It's an actual approach that rich families like the Rockefellers and Rothschilds have been using for generations.

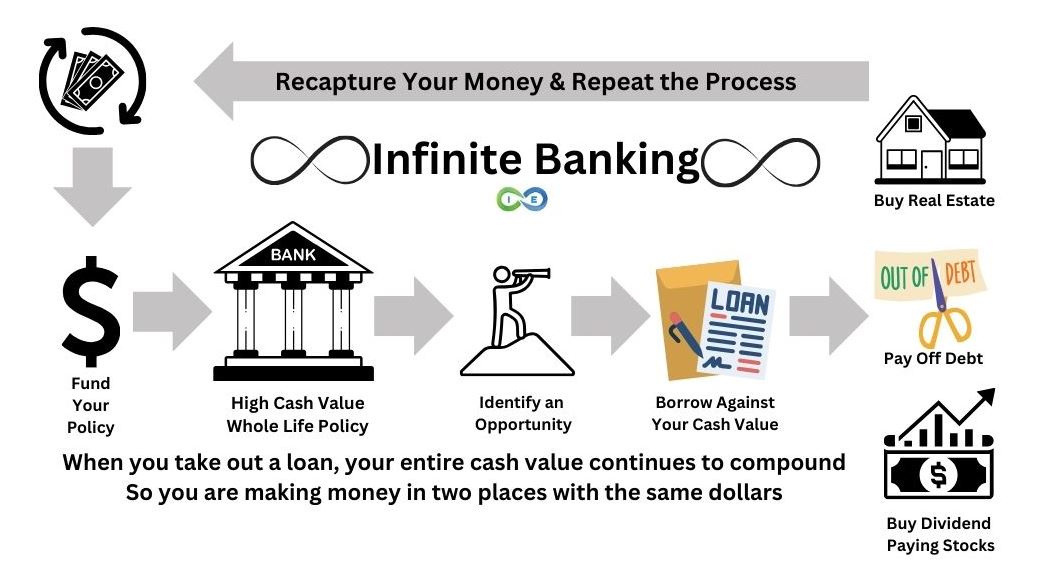

Currently, before you roll your eyes and assume, Wait, life insurance policy? That's boring.stay with me. This isn't the type of life insurance coverage lots of people have. This is a high-cash-value policy that allows you to: Store your money in a location where it grows tax-free Borrow against it whenever you require to make financial investments or significant purchases Earn nonstop substance rate of interest on your money, also when you borrow versus it Consider how a financial institution functions.

With Infinite Banking, you become the bank, gaining that rate of interest rather than paying it. It's a complete standard shift, and as soon as you see exactly how it works, you can't unsee it. For the majority of us, cash drains of our hands the 2nd we obtain it. We pay bills, make purchases, pay for debtour bucks are regularly leaving us.

How To Take Control Of Your Finances And Be Your Own ...

The insurance provider doesn't need to get "paid back," because it will simply be deducted from what obtains distributed to your beneficiaries upon your expiry day, as Hannah so euphemistically called it. You pay yourself back with passion, similar to a bank wouldbut now, you're the one profiting. Allow that sink in.

It has to do with rerouting your cash in a manner that constructs wealth as opposed to draining it. If you remain in actual estateor intend to bethis strategy is a goldmine. Let's claim you desire to buy a financial investment property. As opposed to mosting likely to a financial institution for a lending, you borrow from your very own plan for the down settlement.

You utilize the financing to acquire your home. That's what Hannah calls double-dippingand it's exactly how the well-off maintain expanding their cash.

Non Direct Recognition Insurance Companies

Let's clear a couple of up. Below's the thingthis isn't an investment; it's a financial savings method. Investments include risk; this doesn't. Your cash is guaranteed to expand regardless of what the stock exchange is doing. Perhaps, but this isn't about either-or. You can still purchase genuine estate, supplies, or businessesbut you run your cash through your policy initially, so it maintains expanding while you invest.

We've been educated to believe that banks hold the power, yet the truth isyou can take that power back. Hannah's family members has been using this strategy given that 2008, and they currently have over 38 policies funding actual estate, financial investments, and their family members's financial legacy.

Becoming Your Own Banker is a message for a ten-hour training course of instruction concerning the power of dividend-paying whole life insurance. The market has actually concentrated on the fatality advantage high qualities of the contract and has ignored to sufficiently explain the funding capacities that it offers for the policy owners.

This publication shows that your requirement for finance, throughout your life time, is a lot above your demand for defense. Address for this need through this instrument and you will wind up with more life insurance policy than the firms will certainly issue on you. The majority of everybody recognizes with the truth that a person can borrow from a whole life policy, yet as a result of exactly how little costs they pay, there is minimal accessibility to cash to finance major products needed throughout a lifetime.

Truly, all this publication includes in the formula is range.

Latest Posts

Life Insurance As A Bank

R. Nelson Nash On Becoming Your Own Banker

Infinite Banking Reviews